Jonathan Ruffer: tech stocks have become “long-duration assets”

As with bonds, tech stocks are now held not because of that they are, but because of what investors fear if they don't hold them, says Jonathan Ruffer, chairman of Ruffer Investment Management.

Consider what “the easy route to a successful portfolio in 2020 would have been”, says Jonathan Ruffer, the founder of the £20bn asset manager that bears his name, in his latest letter to investors. First, hold firms such as Amazon “where Covid-19 has blown a mighty following wind”. Second, recognise “that pressure on central banks to cut interest rates further would be irresistible” and buy government bonds before they did so. If you did either, you had a very good year. “But a change in a single variable will sideswipe both those asset classes at the same time. Their dynamics feel very different, but actually, they are not.”

In the eyes of the market, the long-term earnings power of tech stocks has become “more and more valuable” when “discounted at lower and lower interest rates”. They are now “long-duration assets” (ie, their value is very sensitive to changes in interest rates). So their fate will be closely linked to that of bonds.

At this point, investors hold tech because people “fear not holding these stocks”. They hold bonds not for income, but because of “the chess game that plays out between the authorities and the investment community”, under which markets feel they have policymakers trapped “in low-yield (pushing into no-yield) territory”.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

When sentiment and circumstances change, so will the calculations that prop up both asset classes. “If inflation comes about – or, rather, looks a realistic possibility – you won’t see government bonds or tech stocks for dust.”

-

What is bitcoin halving and what does it mean for crypto investors?

What is bitcoin halving and what does it mean for crypto investors?Bitcoin halving is likely to take place this week, according to experts. Historically, this practice has caused the cryptocurrency to soar in value. But will this time be different?

By Katie Williams Published

-

British Airways revamps Avios scheme bringing down flight prices to £1

British Airways revamps Avios scheme bringing down flight prices to £1With the new Avios part-payments scheme you can now bag a British Airways flight for as little as £1

By Oojal Dhanjal Published

-

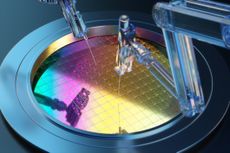

The industry at the heart of global technology

The industry at the heart of global technologyThe semiconductor industry powers key trends such as artificial intelligence, says Rupert Hargreaves

By Rupert Hargreaves Published

-

Three emerging Asian markets to invest in

Three emerging Asian markets to invest inProfessional investor Chetan Sehgal of Templeton Emerging Markets Investment Trust tells us where he’d put his money

By Chetan Sehgal Published

-

What to consider before investing in small-cap indexes

What to consider before investing in small-cap indexesSmall-cap index trackers show why your choice of benchmark can make a large difference to long-term returns

By Cris Sholto Heaton Published

-

Why space investments are the way to go for investors

Why space investments are the way to go for investorsSpace investments will change our world beyond recognition, UK investors should take note

By Merryn Somerset Webb Published

-

Time to tap into Africa’s mobile money boom

Time to tap into Africa’s mobile money boomFavourable demographics have put Africa on the path to growth when it comes to mobile money and digital banking

By Rupert Hargreaves Published

-

M&S is back in fashion: but how long can this success last?

M&S is back in fashion: but how long can this success last?M&S has exceeded expectations in the past few years, but can it keep up the momentum?

By Rupert Hargreaves Published

-

The end of China’s boom

The end of China’s boomLike the US, China too got fat on fake money. Now, China's doom is not far away.

By Bill Bonner Published

-

Magic mushrooms — an investment boom or doom?

Magic mushrooms — an investment boom or doom?Investing in these promising medical developments might see you embark on the trip of a lifetime.

By Bruce Packard Published