Five top investment trusts to buy and forget until 2040

Picking winning long-term stocks is extremely difficult but, with a sensible spread of solid funds, investors can look forward to maximum gains with minimum fuss, says Max King

There is a saying on Wall Street: “the definition of a long-term investment is a short-term investment that has gone wrong”. Good traders cut their losses on mistakes and so should good investors, but good investors also hang onto their winners. “Our favourite holding period is forever,” according to Warren Buffett.

Picking the stocks that will be great investments for 20 years is easier said than done, as a glance at the constituents of the FTSE 100 20 years ago shows. Many have not survived. Some of the major tech stocks of 20 years ago have been winners, but have also provided a gut-wrenching roller-coaster ride. Note that the entire gain in the US stockmarket since 1926 is due to the best 4% of listed companies.

Picking investment trusts for the next 20 years is much easier. A diverse portfolio will reduce the impact of poor investments. A good manager, while keeping portfolio turnover low, will navigate the changing opportunities and threats along the way, whether these stem from valuations, the overall economic outlook, or individual businesses. All the investor has to do is pick an area of the market offering attractive long-term potential and find a trust with the right record, investment thesis and management.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Good managers can lose their touch or prove to have been lucky rather than skilful. They also move on and their successor may or may not be able to follow in their footsteps. Seemingly attractive long-term prospects may turn out to have been a mirage. If so, sell. But nothing goes up in a straight line, so expect setbacks and even long periods of dull performance when fundamental value catches up with the share price.

In my first article for MoneyWeek in September 2002, I recommended Baillie Gifford Japan and Invesco Perpetual UK Smaller Companies. The former has since risen ninefold; the latter, with dividends reinvested, eightfold. I still hold the former, but switched the latter into BlackRock Smaller Companies ten years ago: Invesco’s manager changed and the BlackRock trust was trading on a much higher discount to net asset value (NAV). This added 25% to returns over the last five years. Both trusts are in my top-five for the next 20 years, along with other long-standing favourites.

Baillie Gifford Japan Trust (LSE: BGFD)

BGFD has rather lost its shine since Sarah Whitley retired as manager three years ago. It is now the only Baillie Gifford trust that does not top the performance table in its sector. But that may prove temporary as its performance has picked up strongly in recent months. The portfolio is divided into “secular-growth” (51%), “internet-related” (31%) and “automation-related” (14%) stocks. Annual portfolio turnover is just 21%, with six new holdings and eight sold last year in a total of 70. The investment opportunity in Japan is one of the best in the world, yet it is under-represented in most global funds. Corporate Japan, galvanised by the arrival of Prime Minister Shinzo Abe in 2012, has been steadily changing in recent years. Profit margins have risen from 4% to 6%, companies are concentrating on their core businesses and are more focused on creating value for shareholders. Still, the Topix index is trading at just 17% above book value (mostly tangible assets) and yielding 2.4%. Earlier this year, it was on its lowest price/earnings (p/e) ratio for 50 years. Warren Buffett recently invested $6bn in Japanese companies – surely a green light for sceptical investors.

BlackRock Smaller Companies (LSE: BRSC)

BRSC, which focuses on British small caps, has outperformed its benchmark, the Numis Smaller Companies index, for almost 18 consecutive years. The index has in turn eclipsed the broader market by an annual 3.2% for over 60 years. Still, the index has lagged a weak UK market this year. Over three years the index is down by 13%, while BRSC is up by 4%, so UK smaller companies are due a return to favour.

Investors’ current scepticism is reflected in BRSC’s lagging share price, which is now at a 15% discount to NAV, while the yield is 2.7%. The style is growth and quality, for which the manager, Roland Arnold, is prepared to “pay a slightly higher multiple of earnings”. The number of holdings, at over 120, is high but the top-ten holdings account for 20% of the portfolio and the top 50 for 62%. Arnold believes “this environment will prove to be a fantastic opportunity”.

Polar Capital Technology Trust (LSE: PCT)

I didn’t have the nerve to include PCT in the 2002 article, having held it all the way up and all the way down the dotcom bubble. This was clearly a mistake, as the share price has since multiplied 26-fold. Allianz Technology Trust, which I also hold, has outperformed over five years (328% versus 292% in NAV terms), but I am happy to hold both. PCT has over 100 holdings. Its manager, Ben Rogoff, seeks to invest in the high-growth phase – when “companies are apparently expensive but revenue and earnings forecasts are wrong” – before selling out before maturity, when companies become value traps. He avoids “blue-sky pre-revenue companies which often end in disillusion”.

It may be tempting to avoid a technology specialist trust for now and wait for a better opportunity, but the sector could go a lot higher before there is a meaningful setback. There is no sign that the industry’s phenomenal earnings growth is coming to an end, so a forward price/earnings (p/e) multiple well into the 20s is justified. There are certainly companies to avoid and accidents waiting to happen, but the portfolio’s diversity means that the impact of the mistakes should be small.

Worldwide Healthcare Trust (LSE: WWH)

The case for long-term investment in healthcare is compelling. It is based on rising populations, people’s desire to live a long and healthy life, their readiness to see a disproportionate part of their increasing prosperity spent on healthcare and the accelerating pace of innovation in the industry. Against that, affordability is finite, innovation takes time and is risky, regulators often drag their feet and the sector is a perennial political football. This means that performance is cyclical with periods of strong performance followed by dull phases that can last years.

I have held WWH since its launch in 1995, since when its share price has multiplied 35-fold. At first it invested only in pharmaceutical and biotechnology companies, but its remit was broadened to include medical equipment, healthcare services and providers. Those wanting a trust at the sharp end of innovation should consider its sister trust, Biotech Growth (LSE: BIOG), but although BIOG has performed much better over the last year, the five-year record is similar.

Finsbury Growth & Income Trust (LSE: FGT)

I have held FGT for even longer, though not continuously. The strategy of its manager of nearly 20 years, Nick Train, is to hold the shares of companies whose brands and business franchises give them longevity, mainly in consumer goods (such as Unilever), financial services (London Stock Exchange) and services (publishing group RELX). These companies generate reliable long-term growth throughout economic cycles.

There are just 25 holdings. In February the average age of the companies in the portfolio was 148 years; 80% of the portfolio is listed in the UK, but many of the holdings have a major international presence. Train is a keen follower of the Buffett principle of holding stocks forever, so portfolio turnover is between zero and 10%. In one year it was just 0.5%, equivalent to turning the portfolio over every 200 years.

As a result, Train has had the time to climb all of Scotland’s 282 Munros (mountains over 3,000ft). The trust’s five-year performance of 69% is 50% ahead of the All-Share index, yet the shares trade 12% below their 2019 peak, providing an opportunity for new investors given that the companies in the portfolio continue to prosper.

Consider these too

A portfolio of trusts for the next 20 years should also include an emerging-markets one. JP Morgan Emerging Markets Investment Trust (LSE: JMG) is the most consistent, having returned 112% over five years, almost double the MSCI emerging markets index, yet it still trades on an 8% discount to NAV. Exposure to private equity is also essential. HG Capital Trust’s (LSE: HGT) focus on technology makes it the star of the sector with a five-year return of 137%, although the discounts of an average 27% to NAV of the funds of funds, such as Pantheon International (LSE: PIN) and HarbourVest Global Private Equity (LSE: HVPE), will tempt bargain-hunters.

Finally, no portfolio should be without a core of high-quality global funds. The phenomenal performance of the sector’s £14bn giant, Scottish Mortgage Investment Trust (LSE: SMT) – up by 338% in five years – makes rivals seethe with envy. Its portfolio is made up of high-growth, technology-driven companies with an increasing exposure to private equity. Of course, these companies look expensive, but that doesn’t make them overpriced. It’s my largest holding. A long way behind, but still boasting an impressive performance from a lower-octane approach to growth, are Scottish Mortgage’s sister trust Monks Investment (LSE: MNKS), Mid Wynd International Investment (LSE: MWY) and Martin Currie Global Portfolio (LSE: MNP).

The advantage of a well-chosen portfolio of trusts is that you can leave it alone for long periods of time; a busy quarter might be two trades. There is no need to worry about the underlying stocks – that’s what the managers are paid to do. Just keep an eye on the overall performance from time to time. Resist the temptation to take profits in order to reinvest in the laggards.

If you are bothered about market volatility, just check prices less often. Not all the trusts will prosper for 20 years, but don’t be pushed around by market sentiment; that’s the way to buy at the high and sell at the low. Managers will come and go, but directors are not fools and should ensure continuity. If it’s worked for me, it can for anyone.

Max has an Economics degree from the University of Cambridge and is a chartered accountant. He worked at Investec Asset Management for 12 years, managing multi-asset funds investing in internally and externally managed funds, including investment trusts. This included a fund of investment trusts which grew to £120m+. Max has managed ten investment trusts (winning many awards) and sat on the boards of three trusts – two directorships are still active.

After 39 years in financial services, including 30 as a professional fund manager, Max took semi-retirement in 2017. Max has been a MoneyWeek columnist since 2016 writing about investment funds and more generally on markets online, plus occasional opinion pieces. He also writes for the Investment Trust Handbook each year and has contributed to The Daily Telegraph and other publications. See here for details of current investments held by Max.

-

Barclays warns of significant rise in social media investment scams

Barclays warns of significant rise in social media investment scamsInvestment scam victims are losing an average £14k, with 61% of those falling for one over social media. Here's how to spot one and keep your money safe

By Oojal Dhanjal Published

-

Over a thousand savings accounts now offer inflation-busting rates – how long will they stick around?

Over a thousand savings accounts now offer inflation-busting rates – how long will they stick around?The rate of UK inflation slowed again in March, boosting the opportunity for savers to earn real returns on cash in the bank. But you will need to act fast to secure the best deals.

By Katie Williams Published

-

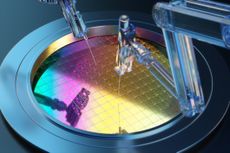

The industry at the heart of global technology

The industry at the heart of global technologyThe semiconductor industry powers key trends such as artificial intelligence, says Rupert Hargreaves

By Rupert Hargreaves Published

-

Three emerging Asian markets to invest in

Three emerging Asian markets to invest inProfessional investor Chetan Sehgal of Templeton Emerging Markets Investment Trust tells us where he’d put his money

By Chetan Sehgal Published

-

What to consider before investing in small-cap indexes

What to consider before investing in small-cap indexesSmall-cap index trackers show why your choice of benchmark can make a large difference to long-term returns

By Cris Sholto Heaton Published

-

Why space investments are the way to go for investors

Why space investments are the way to go for investorsSpace investments will change our world beyond recognition, UK investors should take note

By Merryn Somerset Webb Published

-

Time to tap into Africa’s mobile money boom

Time to tap into Africa’s mobile money boomFavourable demographics have put Africa on the path to growth when it comes to mobile money and digital banking

By Rupert Hargreaves Published

-

M&S is back in fashion: but how long can this success last?

M&S is back in fashion: but how long can this success last?M&S has exceeded expectations in the past few years, but can it keep up the momentum?

By Rupert Hargreaves Published

-

The end of China’s boom

The end of China’s boomLike the US, China too got fat on fake money. Now, China's doom is not far away.

By Bill Bonner Published

-

Magic mushrooms — an investment boom or doom?

Magic mushrooms — an investment boom or doom?Investing in these promising medical developments might see you embark on the trip of a lifetime.

By Bruce Packard Published