Decimalisation: Britain’s “new pence” turn 50 years old

In 1971 the UK adopted a decimal currency. The shift was widely thought to be a step towards joining the Common Market, but there was more to it than that, says Max King.

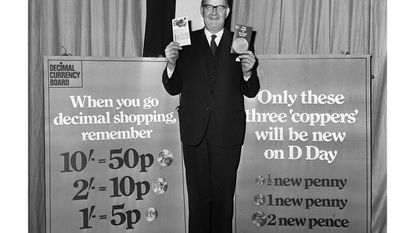

15 February marks the 50th anniversary of the day when, after 150 years of proposals, debate and Royal Commissions, Britain finally adopted a decimal currency. The old system of 12 pennies to the shilling and 20 shillings to the pound was replaced by a simple 100 “new pence” to the same old pound. Only a few nostalgic diehards disapproved.

It was widely thought that decimalisation was a precondition of Britain joining what was then called the European Economic Community (EEC) two years later. In fact, decimalisation had been progressing around the world since it was first adopted by the newly formed United States in 1786 and France in 1795. Canada adopted the dollar (a word derived from the central European thaler) upon self-government in 1867.

In 1957, India replaced a rupee divided into 16 annas, each sub-divided into 12 pies, with 100 new pies to the rupee. South Africa followed in 1961 when it adopted the rand, Australia in 1966, New Zealand in 1967 and British colonies when they achieved independence. By 1971, only the UK and Ireland were left. Ireland’s currency was de-facto tied to sterling 50 years after independence – perhaps a lesson for the Scottish nationalists today.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A Roman legacy

The old currency wasn’t quite as British as it seemed. The abbreviations £, s and d were respectively short for the Latin libra, sestercii and denarii, the coinage of Rome. The lira was the currency of Italy and Turkey, the schilling that of Austria and the pfennig was the German parallel to the penny. The two-shilling coin was known as a florin, the currency of the Netherlands, and the 2s6d or 2/6 coin was “half a crown,” the crown being the unit of currency in Scandinavia. There was no crown coin except for commemorative issues.

The slang word for the sixpence was “a tanner” and for a shilling “a bob”, a word that barely survives in the saying “as bent as a nine bob note”. The “guinea”, or 21 shillings, had been withdrawn in the early 19th century but private doctors, lawyers and auctioneers continued to charge in guineas, probably to squeeze an extra 5% from clients. It survives in the Newmarket races, known as the “1000 guineas” and the “2000 guineas”. The groat, 4d, had disappeared in Victorian times, being unnecessary alongside the 3d coin or “thruppence”. The farthing, remembered in the penny-farthing bicycle, was withdrawn in 1960 and the ha’penny in 1967.

Old coins remained in circulation, as did coins from countries formerly in the sterling area. Late and even mid-Victorian pennies continued to appear in change right up until decimalisation. “Silver” coinage only dated back to the interwar period, when the silver content of the coins was first reduced as the silver content came to be worth more than the denomination, and then replaced by cupro-nickel. The silver thruppence was replaced by a new brass coin, similar in size and shape to the new pound coins, in the late 1930s. The penny, thruppence and half-a-crown were withdrawn at decimalisation, as was the ten-shilling note, to be replaced by ½p, 1p, 2p and 50p coins, but other pre-decimalisation coins remained in circulation. The sixpence disappeared in 1980 but the shilling and florin coins, the same size and of the same value as the new 5p and 10p coins, continued in circulation until 1990. The shilling remains the unit of currency in East Africa.

Stuck in transition

If adoption of a decimal currency was a slow process, full metrification has been even slower, though it has been taught in school maths and science since the early 1970s. The 1985 Weights & Measures Act implemented EEC directives on metrification, but the timetable for full changeover has been repeatedly delayed. So we still use miles and acres rather than kilometres and hectares and many still refer to their height in feet and inches and their weight in stones and pounds. Food and fuel is sold in kilogrammes and litres, but Celsius and Fahrenheit co-exist for temperature. There is little pressure for full metrification, though few people are capable of converting between metric and imperial systems.

The UK is not the only country stuck in transition. The US, the first country to adopt a decimal currency, still uses the imperial system for weights and measures. Recipes use cups and tea/tablespoons as measures, long abandoned even in the UK. Not even in America, though, are microscopic distances referred to as nano or pico-inches. That illustrates a deeper truth: decimalisation and metrification were not pushed through by the EU, politics or modernising social pressures, but by electronic technology. Metric is the only system that pocket calculators, introduced in the early 1970s, or computers understand.

Max has an Economics degree from the University of Cambridge and is a chartered accountant. He worked at Investec Asset Management for 12 years, managing multi-asset funds investing in internally and externally managed funds, including investment trusts. This included a fund of investment trusts which grew to £120m+. Max has managed ten investment trusts (winning many awards) and sat on the boards of three trusts – two directorships are still active.

After 39 years in financial services, including 30 as a professional fund manager, Max took semi-retirement in 2017. Max has been a MoneyWeek columnist since 2016 writing about investment funds and more generally on markets online, plus occasional opinion pieces. He also writes for the Investment Trust Handbook each year and has contributed to The Daily Telegraph and other publications. See here for details of current investments held by Max.

-

Barclays warns of significant rise in social media investment scams

Barclays warns of significant rise in social media investment scamsInvestment scam victims are losing an average £14k, with 61% of those falling for one over social media. Here's how to spot one and keep your money safe

By Oojal Dhanjal Published

-

Over a thousand savings accounts now offer inflation-busting rates – how long will they stick around?

Over a thousand savings accounts now offer inflation-busting rates – how long will they stick around?The rate of UK inflation slowed again in March, boosting the opportunity for savers to earn real returns on cash in the bank. But you will need to act fast to secure the best deals.

By Katie Williams Published

-

Should your business invest in a VoIP phone service?

Should your business invest in a VoIP phone service?Here's what you need to know about VOIP (voice over IP) services before landlines go digital in 2025.

By David Prosser Published

-

The end of China’s boom

The end of China’s boomLike the US, China too got fat on fake money. Now, China's doom is not far away.

By Bill Bonner Published

-

What is the future of Royal Mail in the UK?

What is the future of Royal Mail in the UK?With fewer of us sending letters and parcels, the Royal Mail is finding dealing with the nation’s post is an increasingly unprofitable and costly business.

By Simon Wilson Published

-

What's the secret of Manolo Blahnik's success?

What's the secret of Manolo Blahnik's success?Fashion maestro Manolo Blahnik shows little sign of slowing down at 81, and his company notched up a record financial year in 2022. What is the secret of his success?

By Jane Lewis Published

-

Michelle Mone's "tough year of pain"

Michelle Mone's "tough year of pain"Michelle Mone liked to portray herself as a working-class heroine who worked her way to the top through grit and determination. But her pedestal is built on sand.

By Jane Lewis Published

-

Trevor Milton, the Elon Musk wannabe, is jailed for fraud

Trevor Milton, the Elon Musk wannabe, is jailed for fraudThe former CEO of Nikola, Trevor Milton, has been found guilty of lying about the development of the company's electric trucks.

By Jane Lewis Published

-

Directors should think twice before waiving limited liability

Directors should think twice before waiving limited liabilityShould small-business directors ever provide a personal guarantee in return for bank finance?

By David Prosser Published

-

Why Russia's economy is doing better than predicted

Why Russia's economy is doing better than predictedSanctions were supposed to strangle Russia’s economy, but it seems to be thriving. What’s going on?

By Simon Wilson Published