The charts that matter: it’s all about the stimulus

John Stepek looks at how homes of a pre-election stimulus deal in the US have affected the charts that matter most to the global economy.

In this week’s issue of MoneyWeek magazine we take a closer look at the state of US politics right now, in particular the vexed question of what happens if there isn’t a clear winner in the forthcoming election – and what might that mean for markets? If you’re not already a subscriber, you can get a free gold report, plus your first six issues free, if you sign up today.

What does the breathtaking generosity of British politicians’ defined benefit pension schemes have to do with coronavirus and lockdown policies? Perhaps a lot more than you might think. It’s just one of the topics Merryn and I tackle in the latest podcast.

Our latest “Too Embarrassed To Ask” video offers a beginner’s guide to one of the most important aspects of building a long-term financial plan – asset allocation.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the links for this week’s editions of Money Morning and other web stories you may have missed. Make sure you read Merryn’s latest update on MoneyWeek’s model investment trust portfolio.

- Monday: Why would anyone ever buy a 100-year bond?

- Merryn’s blog: UK stocks will bounce back – make sure your portfolio is adequately positioned

- Tuesday: House prices are rising across the globe, not just in the UK

- MW Investment Trust portfolio update: MoneyWeek’s investment trust portfolio – should we keep the Law Debenture trust?

- Wednesday: Platinum has lost its shine – but the green energy revolution could change all that

- Thursday: Oil stocks: share prices in this hated sector are back at their Covid-19 lows – time to buy?

- Friday: What’s the difference between investing and gambling?

Now for the charts of the week.

The charts that matter

This week, it was all about the stimulus hopes. The chart below doesn’t show it but gold had a solid rally towards the close on Friday on hopes that US politicians are inching closer to a pre-election stimulus deal, despite uncertainty over whether anything at all will happen. That said, it seems unlikely that the paralysis will continue – so it’s more about whether more government spending comes now, or after the next president has been agreed.

(Gold: three months)

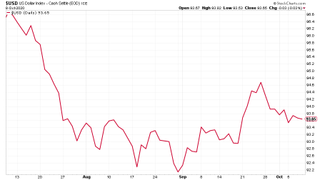

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) was little changed on the week.

(DXY: three months)

The Chinese yuan (or renminbi) was flat against the dollar again this week (when the black line below rises, it means the yuan is getting weaker vs the dollar).

(Chinese yuan to the US dollar: since 25 Jun 2019)

Of more interest, the yield on the ten-year US government bond perked up to its highest level since earlier this year.

(Ten-year US Treasury yield: three months)

The yield on the Japanese ten-year ticked higher too (within its exceptionally tight range).

(Ten-year Japanese government bond yield: three months)

The yield on the ten-year German bund was little changed.

(Ten-year Bund yield: three months)

Copper rallied somewhat this week as investors grew more optimistic on China.

(Copper: nine months)

The Aussie dollar was little changed.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin had a solid rebound this week, no doubt helped by the news that one of Twitter founder Jack Dorsey’s companies – payments platform Square – had bought a large sum ($50m-worth) of bitcoins.

(Bitcoin: three months)

US weekly jobless claims were down on last week, but a little higher than economists had expected. There were 840,000 new claims, down from 849,000 last week (that was revised higher from 837,000). The four-week moving average fell to 857,250 from a revised 870,250 previously.

(US jobless claims, four-week moving average: since Jan 2020)

The oil price (as measured by Brent crude) rallied this week. Oil cartel Opec declared that the “worst is over” for the market. We’ll see (though I wouldn’t be surprised if it is).

(Brent crude oil: three months)

Amazon was a little higher this week...

(Amazon: three months)

While Tesla ended the week a little lower.

(Tesla: three months)

Have a great weekend.

John is the executive editor of MoneyWeek and writes our daily investment email, Money Morning. John graduated from Strathclyde University with a degree in psychology in 1996 and has always been fascinated by the gap between the way the market works in theory and the way it works in practice, and by how our deep-rooted instincts work against our best interests as investors.

He started out in journalism by writing articles about the specific business challenges facing family firms. In 2003, he took a job on the finance desk of Teletext, where he spent two years covering the markets and breaking financial news. John joined MoneyWeek in 2005.

His work has been published in Families in Business, Shares magazine, Spear's Magazine, The Sunday Times, and The Spectator among others. He has also appeared as an expert commentator on BBC Radio 4's Today programme, BBC Radio Scotland, Newsnight, Daily Politics and Bloomberg. His first book, on contrarian investing, The Sceptical Investor, was released in March 2019. You can follow John on Twitter at @john_stepek.

-

Should you invest in UK equities?

Should you invest in UK equities?The FTSE 100 hit a record high this week, but UK equities remain unloved and undervalued compared to their global and US peers. Should you snap them up at a discount?

By Katie Williams Published

-

State pension errors: DWP urged to check for mistakes among divorced people

State pension errors: DWP urged to check for mistakes among divorced peopleFormer pensions minister Steve Webb says there are a high number of divorced women on low state pensions. Now MPs want the DWP to check if there were any errors in “potentially underpaying men and women who are divorced”.

By Ruth Emery Published

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

By Nicole García Mérida Published

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

By Max King Published

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

By Alex Rankine Published

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

By Pedro Gonçalves Published

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

By Ruth Emery Published

-

UK wage growth hits a record high

UK wage growth hits a record highStubborn inflation fuels wage growth, hitting a 20-year record high. But unemployment jumps

By Vaishali Varu Published

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

By John Fitzsimons Published

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

By Jane Lewis Published