The charts that matter: a correction for gold and better news on US jobs

Having ended on a record high last Friday, gold took a big tumble this week. John Stepek looks at the gold price chart, along with the others that matter most to investors.

Welcome back.

In this week’s issue of MoneyWeek, in what has been a somewhat volatile week for gold (and silver), our precious metals specialist Dominic Frisby looks at which mining stocks are the best bets today. If you’re not already a subscriber, get your copy here now. There’s every chance that this one issue could pay for your year’s subscription many times over.

In our latest podcast, Merryn and I talk about house prices, gold, and the one statistic that makes us sceptical of Britain ever seeing a permanent shift to staycations.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We also have a new “Too Embarrassed To Ask” video. This week, in the wake of various dividend cuts, we explain exactly what a “dividend yield” is and why it matters. Take five minutes to let me know what you think, at editor@moneyweek.com – or tell us what you’d like us to cover next.

And I joined The Week Unwrapped podcast again this week. We talked about whether we’ve reached “peak meat”, the ethics of buying a pet for lockdown, and the future for live music. If you fancy hearing my misanthropic views on pets and taking the mickey out of my musical taste, or you’re just interested in a stimulating discussion that’s not all about money, have a listen here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: The pound has been trending higher against the dollar – will it last?

- Merryn’s blog: Should you take advantage of the UK’s new breed of domestic holidaymakers?

- Tuesday: If companies have too much power, we need more competition, not higher taxes

- Wednesday: Gold and silver have taken a vicious beating – is the bull market over already?

- Thursday: No, the UK did not “plunge” into recession yesterday

- Friday: Inflation spiked in the US last month – is this the shape of things to come?

Now for the charts of the week.

The charts that matter

Having ended the week at a record high last Friday, gold took a big tumble (and silver, as ever the more volatile of the two, took a major dive) early in the week, with each suffering heavy losses to hand back a big chunk of their recent epic runs higher. That said, both had stabilised towards the end of the week. To find out what Dominic thinks is next on the cards, magazine subscribers should read his cover story in our latest issue (worth subscribing for, I’d say).

(Gold: three months)

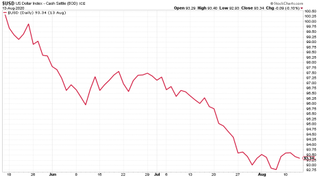

Of course, while gold took a tumble, the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) was bouncing a little after its recent sharp decline. Dollar bulls might argue that this is a turning point – dollar bears would point out that nothing goes down in a straight line. Let’s keep an eye on this one. Bear in mind that a rising US dollar would be painful for asset markets, especially given how high the US stock market is now.

(DXY: three months)

The Chinese yuan (or renminbi) remained fairly static against the US dollar even as the latter strengthened against most other currencies this week (when the black line below falls, it means the yuan is getting stronger).

The Chinese government has the tricky task of trying to balance its desire to position the yuan as a feasible reserve currency (which means it has to be seen as a relatively reliable and stable store of value), with the fact that a weaker currency is helpful for the economy.

(Chinese yuan to the US dollar: since 25 June 2019)

The yield on the ten-year US government bond was somewhat higher on the week – rising to an eight-week high – which helped to support the US dollar.

(Ten-year US Treasury yield: three months)

Even the yield on the Japanese ten-year, which is kept on a very tight leash by the Bank of Japan, pushed higher by its standards.

(Ten-year Japanese government bond yield: three months)

The yield on the ten-year German bund followed the US yield higher too.

(Ten-year Bund yield: three months)

Copper had a tougher week – it’s enjoyed a very strong run so this doesn’t necessarily indicate a major dip in the economic outlook. But it’s worth keeping an eye on – you could argue that we’ve seen the initial V-shaped rebound and now the tough work of seeing the early outlines of our “new” world begins.

(Copper: nine months)

The Aussie dollar took a break from its recent strong run against the US dollar, as the US currency rebounded somewhat.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin has had another solid week. It corrected a little, in line with gold, but enjoyed a stronger rebound than the yellow metal. Of course, bitcoin is well below its previous record high which is not the case for gold. It’ll be interesting to see what happens next.

(Bitcoin: three months)

US weekly jobless claims fell for the second week in a row. Better yet, the number of new claims came in at below the one million mark for the first time since everything went pear-shaped in March. Initial claims came in at 963,000, from 1.19 million last week, better than the expected 1.1 million. The four-week moving average fell back to 1.25 million from last week’s 1.34 million.

US politicians still haven’t agreed a full package to extend unemployment benefits, although US president Donald Trump has signed executive orders that should provide a reduced level of extra benefits.

(US jobless claims, four-week moving average: since Jan 2020)

The oil price (as measured by Brent crude) was little changed this week.

(Brent crude oil: three months)

Amazon was a little lower than last week, despite the tech-heavy Nasdaq index continuing to advance. There’s a lot of speculation at the moment that the world’s dominant internet retailer might decide to follow Apple and Tesla in splitting its shares. This makes the price of an individual share cheaper – so a three-for-one split say, would mean dividing each existing share into three shares.

Of course, in itself, it doesn’t make the stocks any more valuable (it’s like slicing a cake into 20 pieces instead of ten – the cake doesn’t get any bigger). It also seems pointless in an era where you can buy fractions of stocks anyway through all of the brokers that are driving the small investor stock gambling craze.

But Tesla did it and its share price shot up, so what do I know?

(Amazon: three months)

On that point, electric car group Tesla shot up, helped by news of its share split. The split (each existing share will be split into five) isn’t happening until the end of August – but maybe people think small investors are more likely to buy it now? Despite the aforementioned fractional ownership?

Matt Levine of Bloomberg’s Money Stuff probably puts it best. When discussing Apple’s recent stock split, he ran through a whole lot of technical and clever explanations for why splits still happen in these days of fractional ownership (Levine knows his market structure stuff – I highly recommend you read his newsletter).

He then concluded: “I like trying to think of smart explanations for stock splits, but I don’t really believe them… Apple is probably splitting its stock because it will feel better to normal people to have a normal stock price than to have a high stock price.”

This kind of thing is why investors laugh when academics tell us that markets are efficient.

(Tesla: three months)

Have a great weekend.

John is the executive editor of MoneyWeek and writes our daily investment email, Money Morning. John graduated from Strathclyde University with a degree in psychology in 1996 and has always been fascinated by the gap between the way the market works in theory and the way it works in practice, and by how our deep-rooted instincts work against our best interests as investors.

He started out in journalism by writing articles about the specific business challenges facing family firms. In 2003, he took a job on the finance desk of Teletext, where he spent two years covering the markets and breaking financial news. John joined MoneyWeek in 2005.

His work has been published in Families in Business, Shares magazine, Spear's Magazine, The Sunday Times, and The Spectator among others. He has also appeared as an expert commentator on BBC Radio 4's Today programme, BBC Radio Scotland, Newsnight, Daily Politics and Bloomberg. His first book, on contrarian investing, The Sceptical Investor, was released in March 2019. You can follow John on Twitter at @john_stepek.

-

British Airways revamps Avios scheme bringing down flight prices to £1

British Airways revamps Avios scheme bringing down flight prices to £1With the new Avios part-payments scheme you can now bag a British Airways flight for as little as £1

By Oojal Dhanjal Published

-

RBS to close a fifth of branches

RBS to close a fifth of branchesRoyal Bank of Scotland plans to shut 18 branches across Scotland, resulting in the loss of 105 jobs. We have the full list of closures.

By Ruth Emery Published

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

By Nicole García Mérida Published

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

By Max King Published

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

By Alex Rankine Published

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

By Pedro Gonçalves Published

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

By Ruth Emery Published

-

UK wage growth hits a record high

UK wage growth hits a record highStubborn inflation fuels wage growth, hitting a 20-year record high. But unemployment jumps

By Vaishali Varu Published

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

By John Fitzsimons Published

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

By Jane Lewis Published